American tourists are coming. For airlines and ferry services, it will be the 1950s all over again

|

| Varadero Beach, Cuba. Just imagine all the sunburned American tourists.

The U.S. travel industry has spent more than a half-century gazing over a narrow stretch of sea at Cuba, the once and future vacation paradise located just a 45-minute jaunt from one of America's busiest airports.

A presidential declaration in December started the gradual normalization of relations—just last week, in a sign of progress, the U.S. removed Cuba from its list of state sponsors of terrorism—and touched off a rush in the tourism trade. Airbnb accommodations in Cuba, called casas particulares, have doubled to 2,000 since early April, when the lodging company announced its entry into the communist country. As diplomatic negotiations proceed, airlines, cruise lines, and ferry operators are salivating just offstage over the potential size of the U.S.-Cuba travel market.

“If something changed tomorrow, we have everything we need to fly,” says Scott Laurence, senior vice president of network planning at JetBlue Airways, which has been flying charters to Cuba from two Florida cities since 2011 and will start offering Cuban charter flights from New York on July 3. The U.S. Treasury currently authorizes 12 categories of travel to Cuba, including family visits, religious and athletic trips, professional research, journalism, and humanitarian projects.

For almost everyone else in the U.S. unwilling to deal with the illegality of circumventing the 1961 trade embargo, the Caribbean island has remained just out of reach—and therefore a blank canvas for those marketing tropical beaches, robust cigars, old-fashioned cars, and daiquiris served at Ernest Hemingway's old haunts. Even Cuba's economic system, unfamiliar to denizens of the world’s largest economy, could become part of the vacation pitch.

Havana, Peninsular & Occidental S.S. Co.

Source: Jim Heimann Collection

But first the gringos have to get there. The Cuban government predicts 10 million Americans will visit each year after travel opens in full, according to Craig Snyder, president of the World Affairs Council of Philadelphia, a nonprofit educational group that hosted a public event with two Cuban diplomats last month. That number would mark a 10-fold increase over the 1 million projected U.S. visitors for 2015 under newly liberalized rules for American citizens; tourism and business investment in Cuba are still prohibited under U.S. law. Cuba now draws about 3 million total foreign visitors annually, most of them from Canada and Western Europe. Tourist arrivals are up 14 percent this year over the same period in 2014, with an influx of Canadians accounting for much of the gains, according to data released by Cuba's National Office of Statistics last week.

All flights from the U.S. to Cuba at the moment come through charter trips in which an airline leases its plane and crew to an independent operator. This arrangement, in which the charter operator sells tickets, offers guaranteed profit for the carriers. It has also allowed major airlines to learn some of the logistics of flying to Cuba. Even after a 54-year trade embargo, the charter flights eliminate any uncertainty about which Cuban agencies can arrange jet fuel purchases or how to deal with a mechanical problem on the ground in Havana.

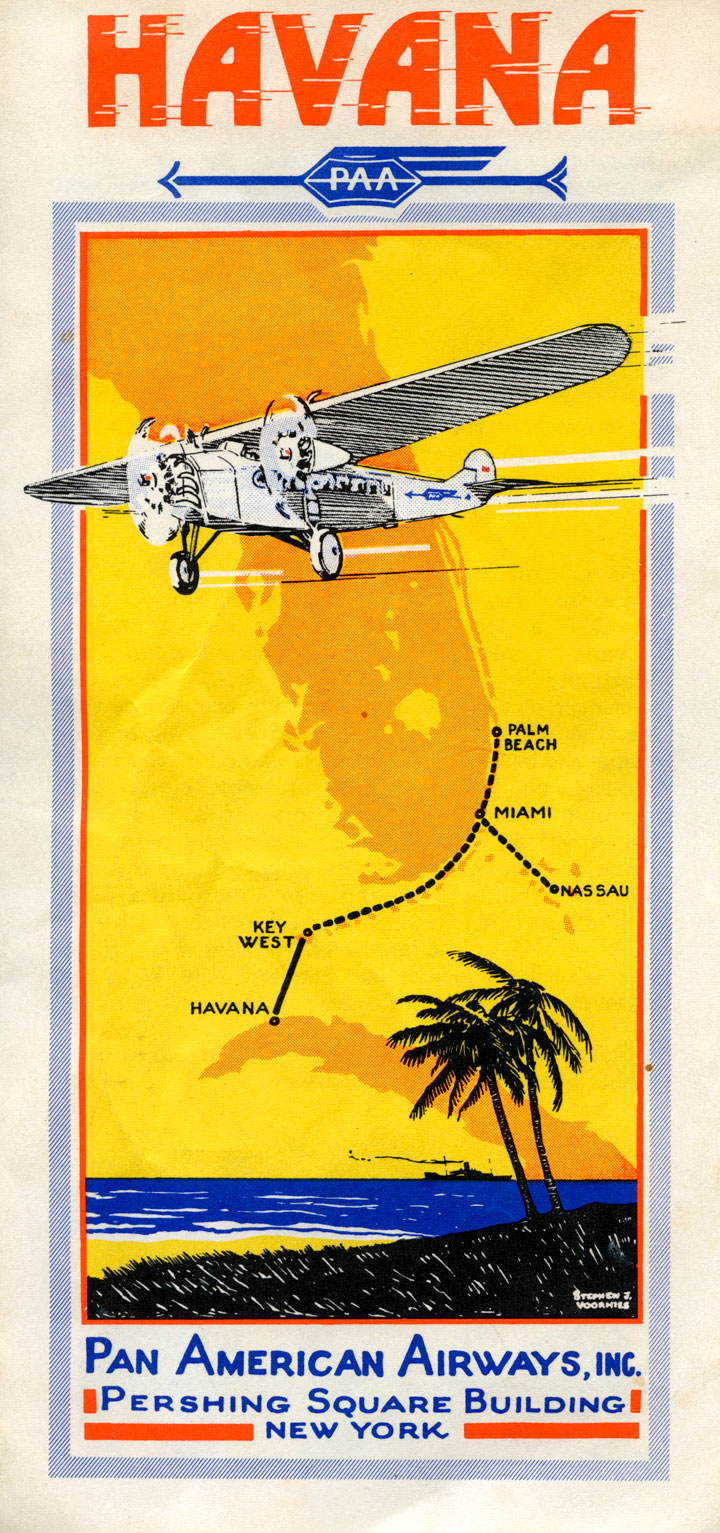

The Air-Way to Havana, Pan American Airways.

Source: Jim Heimann Collection

JetBlue, already in the process of building Fort Lauderdale into a “focus city,” wants to become the first U.S. carrier to resume scheduled service to Cuba once both governments give the green light. American Airlines, with nearly two dozen weekly charters, also counts itself as “anxious to start serving Cuba” when allowed, American President Scott Kirby told reporters in January. Delta Air Lines scrapped its charter runs to Cuba in 2012, citing low profits, but remains ready to return to the market: “We learned what we needed to learn about operating in Cuba for possible future commercial service,” Mike Lowry, general manager of Delta’s charter operations, wrote in a recent company newsletter. Just last month, however, Delta flew a Minnesota symphony orchestra to perform in Havana.

A smaller player, Miami-based startup Eastern Airlines, is using charter flights as a way to help bolster its finances and gain operating experience ahead of its debut of regular scheduled service. Eastern announced last month that it would operate 65 new charter flights per month from Miami to three cities in Cuba, including two daily runs to Havana. American tourists, of course, have sneaked into Cuba for decades via Canada, Mexico, Jamaica, or other nations unaffected by the U.S. embargo. For those Americans allowed to travel directly to Cuba, round-trip charter fares start at about $400 from South Florida for what is a very brief flight.

Cuba's Coming Tourist Boom

It didn't used to be this difficult or expensive to spend a holiday in Havana. Cuba was a casino-filled playground for American travelers throughout the 1950s, with plentiful short flights by Pan American and National Airlines out of Miami, Braniff Air Lines from Houston, Mackey Airlines from Fort Lauderdale, and a daily Delta nonstop from New Orleans. (PanAm’s first flight, in fact, was a 1927 mail run between Key West and Havana.) A Cuban airline, Cubana de Aviation, also flew daily to Miami and New York City.

The air routes faced competition from a flotilla of commercial ferries crossing the Straits of Florida, embarking each day from Tampa, Miami, Palm Beach, and Key West. The 1950s-era cars that today symbolize Cuban street life for many Americans—then in brand-new condition—floated back and forth aboard those ferries. That traffic could soon return, minus the vintage cars: The U.S. Treasury recently granted licenses to a half-dozen ferry operators to begin serving Cuba. Industry observers expect the new boats to be popular thanks to more generous baggage allowances than the airlines and, at least at first, more reasonable prices.

“We are constantly asked, ‘When will the ferry be running,’” one operator, Havana Ferry Partners, posted on its Facebook page last month. The company plans high-speed service from Fort Lauderdale. America Cruise Ferries plans to operate three trips per week from Miami to Havana and hopes to start service this year, said James Whisenand, an attorney for the San Juan (Puerto Rico)-based company. He said the nine-hour overnight trip is expected to cost about $450, comparable to charter flights.

Even with their recent charter experience, Cuba remains a bit of a black box for airline planners. There’s none of the traffic, fare, or population data that helps to undergird most new routes elsewhere in the region. What’s the likely midweek demand? How elastic are ticket prices? Without deep data for a new route, the industry's conventional pricing procedure falls apart. “With Cuba, it’s really unsettling because we don’t have our safety blanket of data,” JetBlue's Laurence says over lunch at a pub near the airline's headquarters in Queens, N.Y.

The robust interest in luggage that the ferry services see as an edge also presents a challenge for airlines accustomed to the lighter-traveling habits formed in the pay-for-baggage era. Flights to Cuba will generally involve larger planes, as many travelers with local family will pack many of the goods that can’t be purchased on the island.

Another wrinkle: Flights to Cuba are likely to be regulated by the type of bilateral agreements that permit access to many other constrained airports, such as those in Beijing, London, New York, and Tokyo. Flights to those cities are closely coordinated to ensure capacity limits aren’t breached. As a result, American or United almost certainly won’t be scheduling flights to Cuba from wherever the company chooses, nor are the airlines likely to be able to fly whenever they please.

Pan American Airways terminal building in Miami in 1940.

Source: Library of Congress

Some of the limits will likely come from the on-the-ground reality of Cuba. Delta Chief Executive Officer Richard Anderson predicted dismal infrastructure would provide an upper limit on tourism. “I mean, Cuba has no infrastructure. It doesn't have a real economy," he recently told the Associated Press. "How do we think this suddenly is going to support dozens and dozens of nonstop flights a day?" A Delta spokesman, Anthony Black, says the airline “looks forward to serving the market when the opportunity becomes available.”

Cuba is likewise eager for U.S. investment but also wants to maintain control over the influx of money so that its economic and political system won't be overwhelmed by capitalists on vacation. “They’re really trying to have it both ways at the moment,” says Snyder of the World Affairs Council, describing the objective of the Cuban government as a “kind of gated development.”

One possible way Cuban officials could hinder any rapid transformations might be to welcome cruise ships—mobile hotels that bring their own infrastructure, contain their guests, and don’t stay too long. Many observers see the cruise industry as a way Cuba might ease into tourism with the U.S. All three of the major lines—Carnival, Royal Caribbean Cruises, and Norwegian Cruise Line—have already expressed interest in adding Cuba to their itineraries.

Over time, travel companies will almost certainly face unforeseen challenges as they push into Cuba. “I think in the longer run it’s going to be a really delicate dance as to whether they can do it the way they want to do it,” Snyder says of the Cuban government. “As opposed to the way a lot of Americans are going to want it, which is very Wild West.”

|

No comments:

Post a Comment